10 Things you Should Know when Approaching Equity Investors

Are you considering equity investors to fund your startup?

1. Advisor Team

The first tip when approaching equity investors is to have an advisor team and to consult them first and foremost before approaching equity investors. They can help you with sorting out the do's and don'ts, as well as provide some insight on the equity investor's perspective when being approached.

Having an advisor team will also give you validation that your equity investors are the right fit for your company, which they need to be in order to invest in your startup.

2. Well Thought Out and Constructed Plan

Having a well-thought-out and constructed equity funding plan is the equivalent of having a map to your success. The equity investors will want to know where you are going and how you plan on getting there, so having a tight equity funding plan will help provide investors with clarity and insight into your equity funding journey.

3. Be on Time

Punctuality communicates much more than simply following a meeting time. Rather being punctual communicates that you are respectful of the investor and their time.

Equity investors are busy dealing with several candidates and therefore what can really set someone apart from their competition is whether they show their respect not only during the meeting but before it as well.

In a world where time equates to money, being punctual has become a non-negotiable and should be prioritized with any meeting.

4. Be Ready

Even though equity funding is not all sunshine and rainbows, equity investors can be an amazing resource for your company. Equity funding should never be taken lightly and equity investors should only partner with companies that they feel passionate about and are dedicated to seeing succeed. Before approaching equity investors, ensure you are ready.

To quote the classic cliché phrase "practice makes perfect". The saying is commonly used because of the truth it holds. Constant repetition leads to mastery of the craft you are practicing. As frustrating as it can be, the goal is to feel well equipped when presenting to equity investors.

Practice will not only help you in feeling prepared but it gives you an insight into how it will feel when presenting your pitch. It allows you to channel the frame of mind needed to effortlessly communicate your impeccable constructed plan.

5. Expect the Unexpected

Adding on to the last tip, before entering your meeting with an equity investor, one must be ready for any and all potential questions. The best way to prepare is to think like an investor and consider what questions they might inquire about and what potential responses they wish to hear.

Equity investors will have their own mental checklist in comparison to your own, therefore you must put yourself in their shoes and hypothesize the potential topics they will inquire about. Doing this step will only add to your toolbox and help you feel confident and ready.

With any new business relationship it is important to establish trust and transparency at all levels. This allows both parties to get on the same page quickly about expectations which ensures there are no surprises along the way. It also helps build long-term relationships between companies where they feel comfortable doing future transactions together because they know everything will run smoothly.

6. Do Your Research

When looking for an equity investor, it is in your best interest to do your research before you successfully secure a meeting with one and even afterward. Knowing who exactly you are entering the lion's den with is immensely important.

Researching will only assist you in feeling better prepared and knowing what the equity investor is most interested in, what they are looking for, and where they choose to entrust their finds in. Doing your research on your investor of interest can also provide you an opportunity to reference their portfolio of work/investments in your meeting.

7. Be Confident, not Cocky

Confidence is key, yet it can often be mistaken for cockiness and arrogance. The goal is to not end up like Icarus and fly too close to the sun, rather the goal is to know your limits when confidently navigating the world of equity investing.

The best way to communicate your confidence is to present factual based evidence instead of speculative information. In the act of selling, often people resort to adding fluff and hypothetical insights to seem more enticing to their potential investors.

Unfortunately, these efforts are often frowned upon and the person runs the risk of looking like a cocky Charleton. Therefore the only thing one must be is confident, clear, and intentional with their words.

8. Notable Achievements

Approaching equity investors with little to no achievements under your belt, can be a huge disadvantage. Being prepared, having a plan, knowing factual based information, and the confidence to approach investors is amazing and highly encouraged yet it is not enough.

The absence of any large achievement is the equivalent to not having gas in the tank, the car can be top of the line but with no fuel, it can not go anywhere and be fully seen by everyone.

Presenting achievements to equity investors greatly assist in instilling the confidence that the investor needs when moving forward in agreeing to do business with you. Achievements are proof of concept and should be considered when building your presentation and pitch.

9. Know you are Being Tested

As you are fully immersed in your meeting, you may be unaware of how much you're being tested by the equity investors in front of you. One of the most important qualities that you are being evaluated on is managerial skills.

Every good company needs a person with strong leadership qualities. With any powerful leader comes success and also communicates to investors confidence, trust, and competency.

A leader who has a plan is organized and is able to properly direct tasks to those under their direction is a sure recipe for a successful and flourishing company.

10. Story

When pursuing an Equity investor, make sure you clearly and concisely communicate your STORY and why it is awesome. When assessing who you are, knowing the origins behind your story adds a personal touch to your presentation.

It communicates your humble beginnings, provides an insight into your work ethic and how hard work mixed with dedication got you where you are today.

When equity investors take equity investments it is because they are passionate about the company. The investment is not just a dollar amount, their commitment to the company and people involved is like none other.

Therefore you need to communicate your story with passion and energy as equity investors need to understand WHY you exist today.

Consider these 10 tips when courting an Equity Investor

Choosing an equity investor and going about the process of finding one can be an overwhelming task. These 10 tips are crucial when entering the realm of equity investments. These tools will help propel you forward in a confident manner when pursuing and navigating the world of investments.

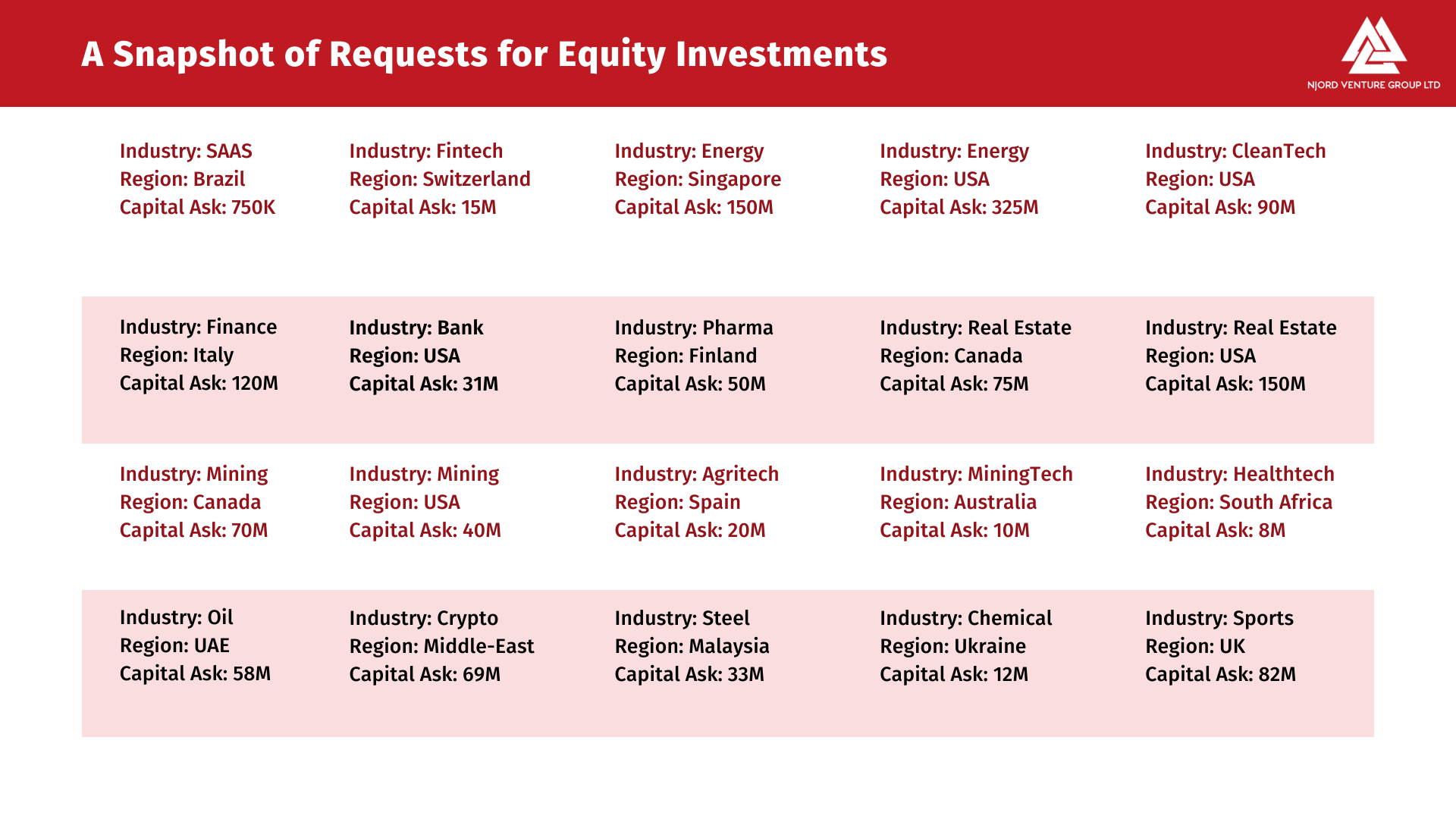

Finding a proper Financial Partner through Njord.ai ensures businesses can find Private Equity and Venture Capital options that work best for their specific needs, without having to go through traditional channels or firms who don't fully understand your business.

If your group is interested in learning more about how to be paired with a Financial Partner,

click here.

Share

Njord Venture Group News and Articles